With Susana Moreira, H2Global Foundation Executive Director, and Co-chair

“Strategies, challenges, and market development for Underground Hydrogen Storage (UHS) within the European hydrogen ecosystem.”

Official Press Release

[Paris, 5th December, 2024]

H2eart for Europe is an EU-wide, CEO-led alliance, composed of thirteen Storage System Operators (SSOs) from across Europe, committed to accelerating the decarbonisation of the European energy system at the lowest cost to society by scaling up the deployment of UHS.

H2Global Foundation is an international non-profit dedicated to accelerate the emergence of clean hydrogen markets and other low-emission fuels worldwide by empowering governments to actively shape and support the ramp-up of the international clean hydrogen market.

In this interview, Susana Moreira, H2Global Foundation Executive Director and Co-chair, shares invaluable insights into the strategies, challenges, and opportunities shaping Underground Hydrogen Storage (UHS) as a cornerstone of Europe’s hydrogen economy.

Susana Moreira, H2Global Foundation Executive Director, and Co-Chair

Interview:

H2eart for Europe: “Could you outline the core mission and goals of H2 Global? What are the primary challenges the organization aims to address in the hydrogen market, and how do you envision H2Global’s role evolving as the market develops?”

Susana Moreira, H2Global Foundation Executive Director: “H2Global accelerates the creation of markets for clean hydrogen and other low-emission fuels through a pioneering double-auction mechanism combined with an intermediary—Hintco—that enters contracts with sellers and buyers that often struggle to connect independently at an early stage of market development. This intermediary then buys products—which are typically more expensive than their carbon-intensive counterparts—to sell them through an auction at a lower price to end consumers supporting demand build up. The price difference is covered by public funding though conceivably it could also be covered by climate funds, private capital, or a combination thereof. In doing so, the H2Global mechanism simulates a functioning market for clean hydrogen, helping shift market creation forward, and has been recognized as the sole active green market maker.”

H2eart for Europe: How does H2Global approach collaboration with organizations like H2eart? Are there specific areas, where you see the most productive engagement?

Susana Moreira, H2Global Foundation Executive Director: “H2Global’s research arm actively engages in knowledge exchange with organizations like H2eart, which provide valuable insights into the evolving hydrogen economy. H2Global’s research team and H2eart have thus far focused their engagement on the role of underground hydrogen storage (UHS) in creating a sustainable and resilient future energy system.”

H2eart for Europe: “What is H2Global’s perspective on the importance of infrastructure and storage for the growth of the hydrogen economy? In what ways is the organization looking to support or influence the development of essential infrastructure, including storage solutions, to ensure supply stability and scalability?”

Susana Moreira, H2Global Foundation Executive Director: “H2Global recognizes that robust infrastructure, including large-scale underground hydrogen storage, is fundamental to enabling the global trade of hydrogen and its derivatives. Simply put, without infrastructure, there can be no trade—and conversely, the absence of trade hinders investment in the necessary infrastructure. H2Global addresses this challenge by stimulating market creation through Hintco’s auctions. Hintco’s purchase and sale agreements provide certainty about the quantity and direction of future physical trade flows of hydrogen and its derivatives from producers to offtakers. This provides a powerful indirect incentive for investment in infrastructure, laying the groundwork for a scalable and stable hydrogen economy.”

H2eart for Europe: “Could you share any insights into the upcoming H2Global report? What are the key themes or findings, and how might they impact future strategies and investments in the hydrogen infrastructure and storage sector?”

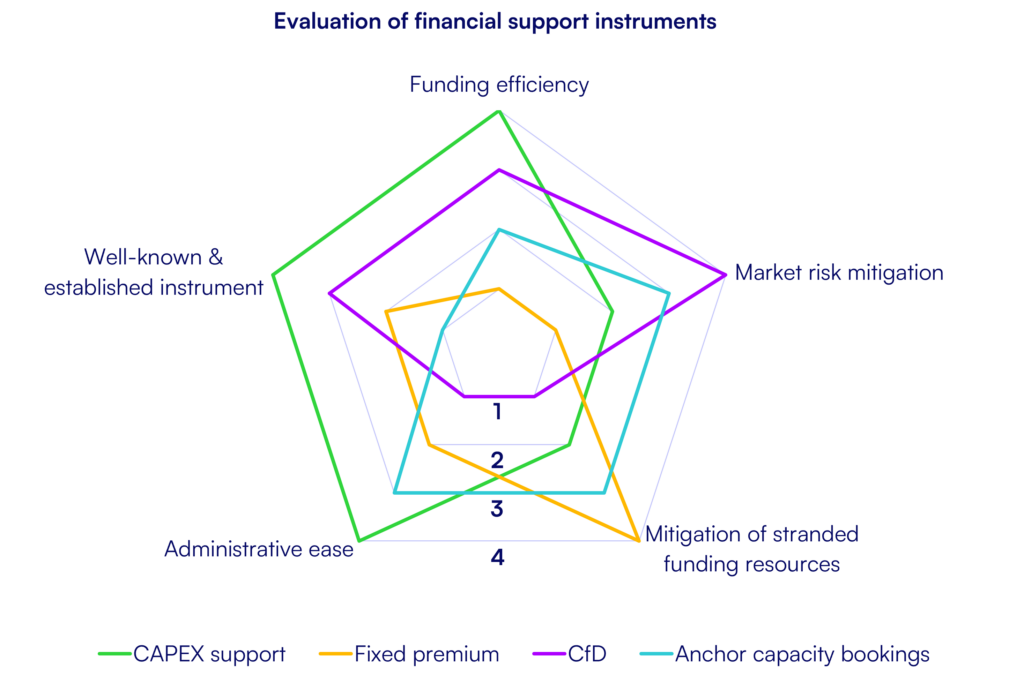

Susana Moreira, H2Global Foundation Executive Director: “The upcoming H2Global report “Bridging the gap: Mobilizing investments in hydrogen infrastructure” provides key insights into how diverse financial support mechanisms can support investment in midstream hydrogen infrastructure, including pipelines, import terminals, reconversion facilities like ammonia crackers, and underground storage. The report identifies Contracts for Difference (CfD) schemes as the most effective tool for high-cost, high-risk projects, offering stable returns and mitigating market risks. CAPEX support appears to be the most efficient tool in reducing upfront costs, particularly in emerging markets, but it needs to be paired with other mechanisms to address long-term revenue risks. Anchor capacity bookings are a valuable approach to ensuring revenue floors during early operations, balancing simplicity with risk mitigation. Collectively, these mechanisms play a crucial role in derisking investments and driving the build-up of hydrogen infrastructure.”

Figure issued from H2Global Foundation Report | Bridging the gap: Mobilizing investments in hydrogen infrastructure.

H2eart for Europe: “Given the high costs and risks associated with UHS, what strategies can be implemented to attract diverse sources of capital, including institutional investors, for long-term infrastructure investments?”

Susana Moreira, H2Global Foundation Executive Director: “To mobilize investments into UHS, it is key to de-risk future revenue streams. This involves securing the utilization of the underground storage facility at a defined price during the ramp-up period of the infrastructure. As highlighted in our upcoming report, Contracts for Difference (CfD) schemes are emerging as a promising financial support mechanism for UHS, providing stable and predictable revenues, and mitigating market risks.”

H2eart for Europe: “How important is it to develop a liquid market for hydrogen storage? What steps should be taken to encourage more dynamic pricing and trading options that would make UHS a more attractive option for market participants? “

Susana Moreira, H2Global Foundation Executive Director: “Developing a liquid market for hydrogen storage is crucial for ensuring the long-term viability of underground hydrogen storage as a business model. While financial support instruments are essential in the early stages, a liquid market inherently de-risks investments by enabling transparent pricing, dynamic trading options, and greater market stability. In a mature market with sufficient liquidity, financial stakeholders are likely to develop trading options and derivatives as natural de-risking tools, reducing reliance on external financial support. To encourage this transition, it is important to foster market transparency and to standardize contracts.”

Find H2Global’s report on financing hydrogen infrastructure here.

About H2eart for Europe

H2eart for Europe is an EU-wide, CEO-led alliance committed to accelerating the decarbonisation of the European energy system at the lowest cost to society by scaling up the deployment of underground hydrogen storage (UHS). Launched in Brussels on 23rd of January 2024, the alliance aims to provide fact-based reports and analysis that can serve policymakers as guidance, and that utilise and build on the experience of our members, leading companies paving the future of hydrogen storage across Europe. We are committed to invest in scaling up UHS infrastructure to meet the flexibility demand in a decarbonised energy system.